Introduction

In the realm of Revenue Cycle Management (RCM), the intricacies of managing contractual adjustments and the consequential impacts on financial reporting cannot be overstressed. As medical practices navigate the challenging waters of insurance claims, understanding the nuances of these adjustments becomes critical to ensuring financial accuracy and sustainability. The process involves managing the financial transactions that result from patient care, starting from the initial appointment scheduling and patient registration to the final payment of the balance. Given the complexity of these transactions, attention to detail in RCM is essential to ensure accuracy, compliance, and financial stability.

Enhancing Accuracy

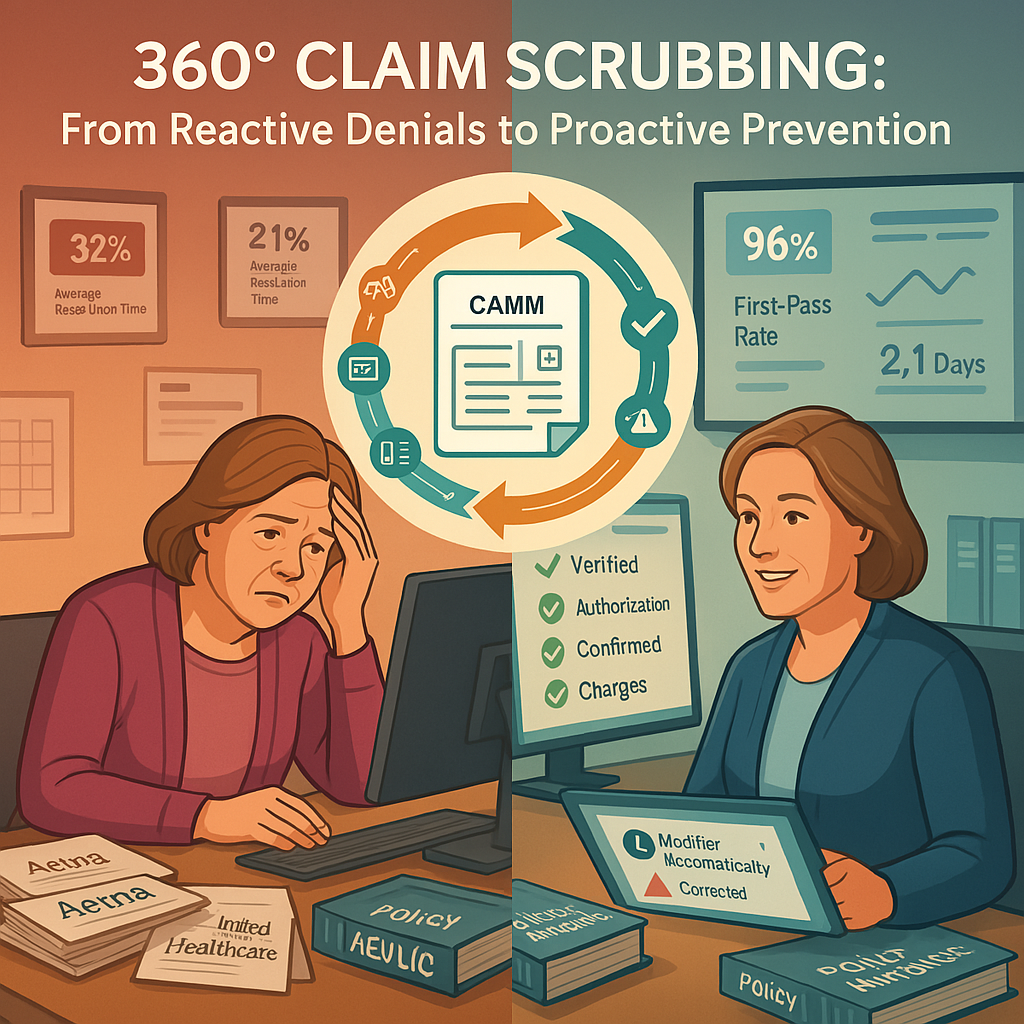

Accuracy in RCM begins with the correct capture of patient information during the registration and scheduling phases. Any errors at this stage, such as incorrect insurance details or patient demographics, can lead to claim denials and delays in payment. Ensuring that all patient data is accurate and up-to-date prevents these issues and streamlines the billing process. Detail in RCM is crucial for avoiding these common pitfalls.

For instance, detailed verification of insurance eligibility before services are provided can prevent claim rejections. By meticulously checking coverage, healthcare providers can avoid unnecessary administrative work and reduce the time spent correcting errors, thereby improving the overall efficiency of the RCM process. This level of detail in RCM is indispensable for maintaining a smooth workflow.

Exploring the Depths of Contractual Adjustments

At first glance, contractual adjustments might seem straightforward, but their implications are profound. They often serve as a veil over deeper issues within the RCM process. For instance, when an account is written off under the guise of a contractual adjustment, it might actually mask underlying errors or mismanagement. This practice can artificially report a high(er) collection rate, potentially misleading stakeholders about the organization’s financial health.

Ensuring Compliance

Healthcare regulations are stringent and constantly evolving. Compliance with laws such as the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA) is non-negotiable. Detailed attention to these regulations during the RCM process helps avoid legal repercussions and fines. Detail in RCM ensures that every regulatory requirement is met, minimizing the risk of costly penalties.

Every step of the RCM process, from coding medical procedures to submitting claims, must adhere to these regulatory standards. Detailed and accurate coding, for example, ensures that claims are not only compliant but also fully reimbursed. Incorrect or fraudulent coding can lead to audits and significant financial penalties, emphasizing the need for meticulous attention to detail in RCM.

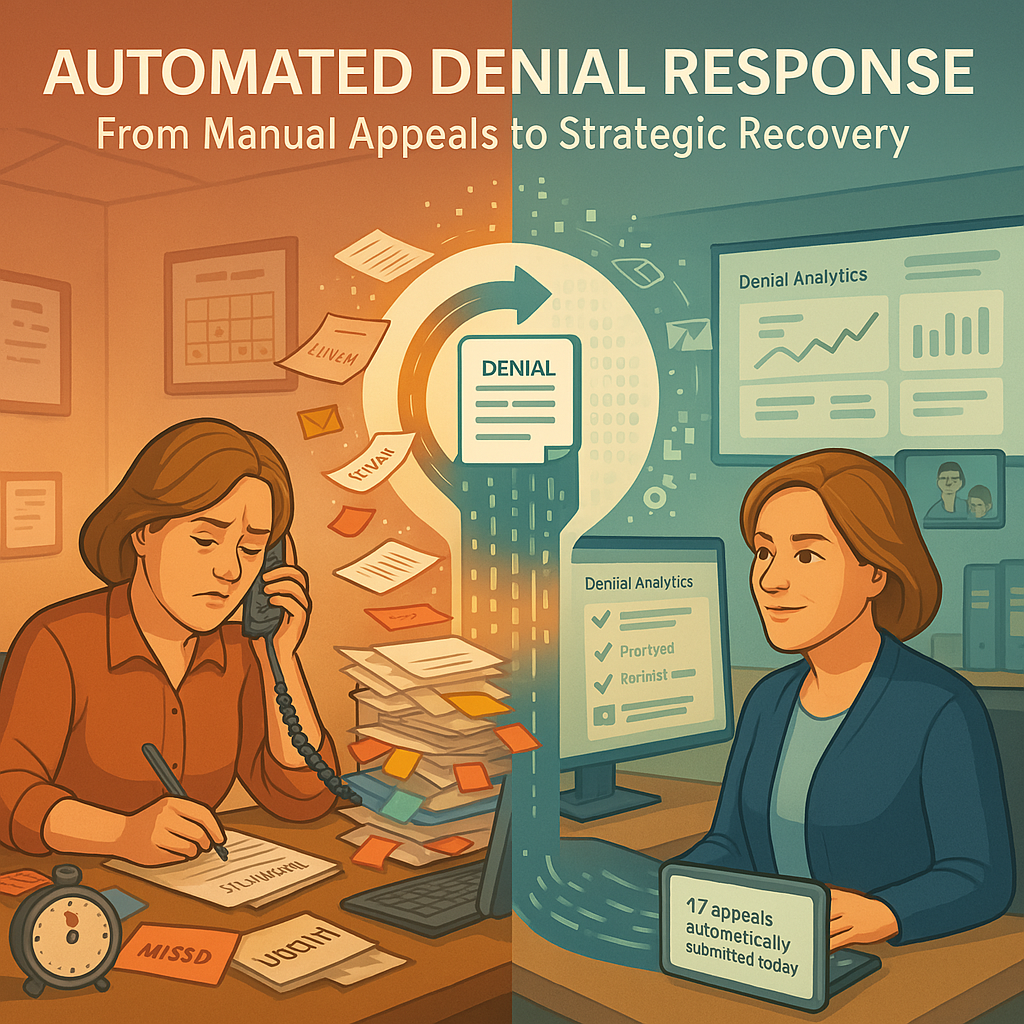

The Risks of Automation in Payment Processing

While automation in payment postings can streamline operations, it’s not infallible. Errors in automated posting, such as failure to properly handle contractual adjustments and reversals, can lead to inaccuracies in the reported financial status. These mistakes are often overlooked due to their technical nature and the complexities involved in tracking them down, especially when it is an externally designed process.

Improving Financial Performance

Detailed RCM practices directly influence the financial performance of healthcare providers. Effective management ensures timely and full payment for services rendered, reducing the accounts receivable days and improving cash flow. By focusing on the details of each transaction, healthcare providers can identify patterns and trends that may indicate inefficiencies or areas for improvement. Detail in RCM is key to unlocking these financial insights.

For example, detailed analysis of claim denials can reveal common reasons for rejections, enabling the implementation of targeted strategies to address these issues. This proactive approach minimizes future denials and ensures a steady revenue stream. Thus, the detail in RCM processes directly contributes to better financial health for healthcare organizations.

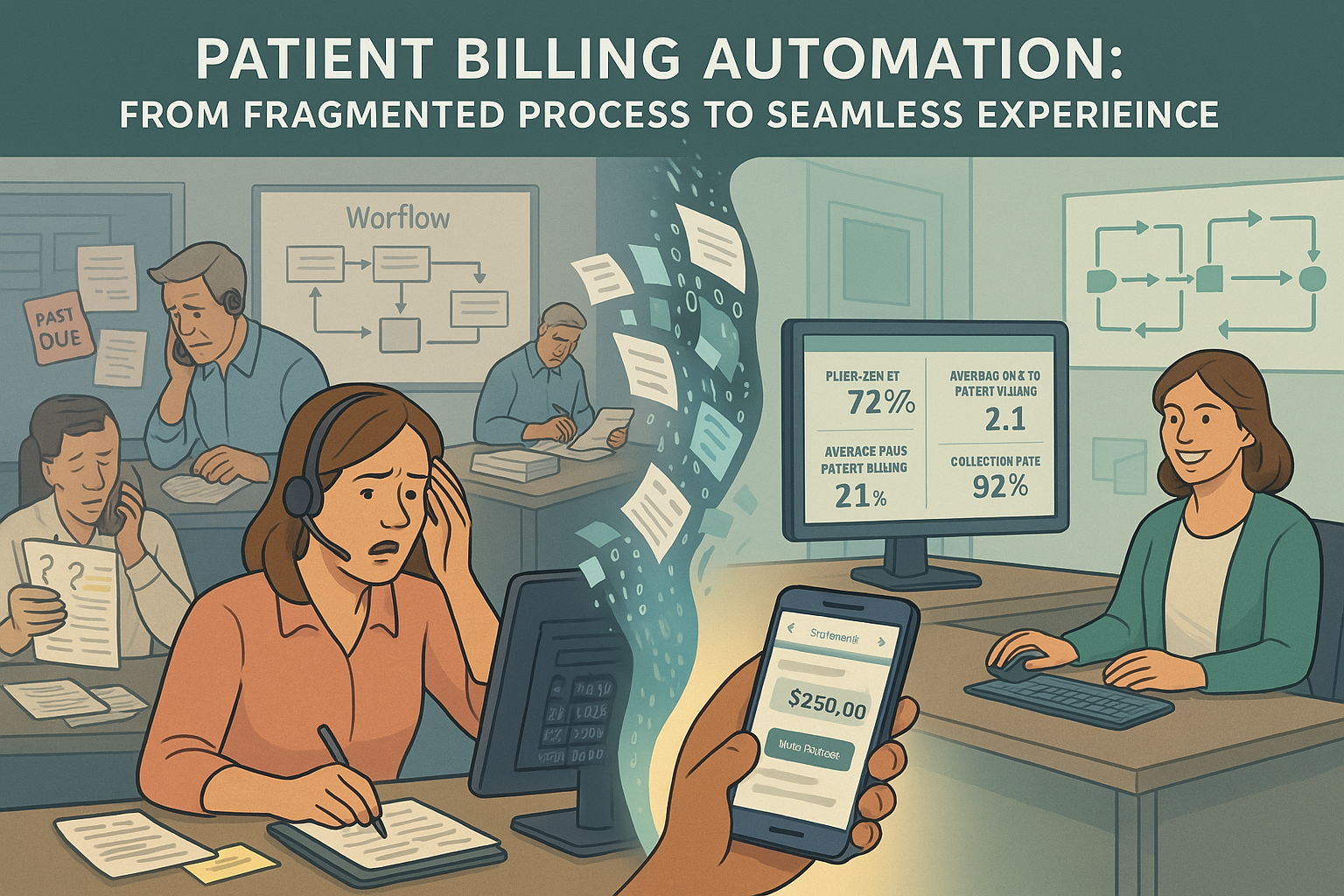

Leveraging Technology

The integration of advanced technology in RCM processes underscores the importance of detail in RCM. Electronic Health Records (EHR) and RCM software systems offer tools to automate and enhance the accuracy of data entry, coding, and claims submission. These systems rely on detailed input and regular updates to function effectively.

By leveraging technology, healthcare providers can reduce manual errors, streamline workflows, and ensure compliance with the latest regulations. Detailed and consistent use of technology also facilitates better data analysis, providing insights that can drive strategic decisions and improve overall RCM performance. The emphasis on detail in RCM through technological adoption is a critical component of modern healthcare administration.

Proactive Measures for Enhanced Transparency

To counter these challenges, practices must adopt a proactive approach in managing their RCM:

- Routine Audits: Regularly auditing posted transactions – both manual and autoposted – helps identify and rectify discrepancies that could distort financial data.

- Educating Staff: Ensuring that the financial team understands the implications of every adjustment and is capable of identifying errors is crucial. Training should include recognizing unusual patterns in payment postings and understanding the detailed functionality of their billing software, particularly how it handles electronic remittance advice (835 files).

- Engaging Advanced Analytics: Leveraging advanced analytics to drill down into the details of every transaction allows practices to uncover patterns that might indicate systemic issues or opportunities for process improvement.

- Strengthening Vendor Communication: Establishing clear communication channels with RCM vendors to ensure that any concerns regarding payment postings and adjustments are promptly and effectively addressed.

Conclusion

Contractual adjustments are more than mere line items on a financial statement; they are indicators of the health and efficiency of a practice’s RCM processes. By deeply understanding and rigorously managing these adjustments, practices can safeguard their financial integrity. By embracing a culture of meticulousness and leveraging advanced technology, healthcare organizations can navigate the complexities of RCM with greater efficiency and success. Detail in RCM is the cornerstone of effective and sustainable healthcare revenue management.