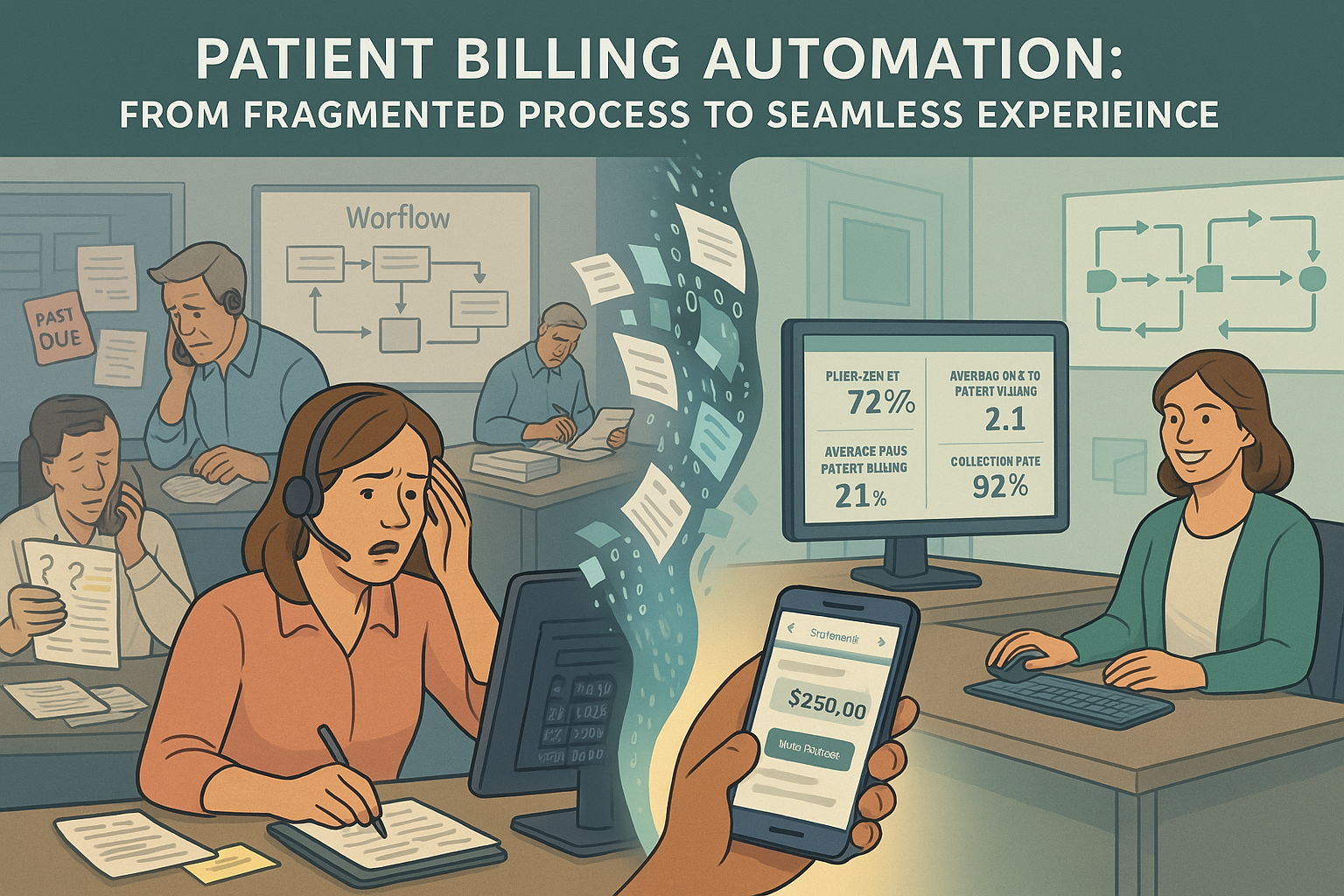

As healthcare organizations face increasing financial pressure from all sides, the patient revenue stream has become critically important. Yet patient billing remains one of the most challenging aspects of revenue cycle management—fraught with complexity, compliance requirements, and high expectations for customer service. In this environment, automation offers a path to simultaneously improve the patient experience while enhancing collection rates and operational efficiency.

The Patient Billing Challenge

For most revenue cycle operations, the current patient billing workflow creates substantial friction:

- Delayed balance transfer: The lag between insurance adjudication and patient billing extends the revenue cycle unnecessarily. The frustration of watching patient balances sit in limbo after insurance has paid—creating both cash flow delays and patient confusion—represents one of the most avoidable inefficiencies in the revenue cycle.

- Statement timing and accuracy: Manual auditing of patient statements delays billing and introduces errors. The exasperation of discovering statement errors after they’ve already reached patients—creating both customer service issues and collection delays—undermines confidence in the entire billing process.

- Small balance management: Significant resources are expended managing balances too small to be economically collectable. The particular annoyance of watching staff time consumed by accounts that cost more to work than they’ll ever generate in revenue creates an obvious operational inefficiency that’s difficult to address without automation.

- Fragmented vendor management: Transferring accounts between early-out and collection vendors creates delays and information gaps. The aggravation of discovering accounts sitting in the wrong status due to missed transfers—or worse, having patients receive conflicting communications from different vendors—damages both the patient relationship and collection outcomes.

- Manual payment posting: Patient payments require staff intervention for proper application. The tedium of manually posting and applying payments across multiple accounts for a single patient creates both operational inefficiency and potential for error, especially when partial payments require allocation decisions.

These challenges impact not only operational efficiency but also patient satisfaction and ultimate collection rates—creating a ripple effect that influences everything from online reviews to overall financial performance.

The Comprehensive Patient Billing Automation Solution

Building on the foundation established by our previous automation components, the patient billing automation solution creates a seamless experience for both patients and staff:

1. Accelerated Balance Management

The system automatically:

- Transfers balances to patient responsibility immediately after insurance adjudication

- Manages insurance reconsideration periods based on payer rules

- Ensures appropriate timing for initial patient statements

- Provides full visibility into balance status throughout the process

The relief of eliminating manual balance transfer tasks cannot be overstated. No more tedious account reviews or batch processing delays—patient balances move through the workflow at the optimal pace, accelerating collections while maintaining compliance with payer requirements.

2. Intelligent Statement Optimization

Before generating statements, the system:

- Consolidates balances across multiple accounts and service dates

- Validates statement accuracy against expected patient responsibility

- Applies configurable small balance write-off rules

- Formats statements according to organizational preferences

The persistent headache of statement auditing and correction is eliminated. Revenue cycle leaders no longer face the particular frustration of discovering statement errors after they’ve reached patients—comprehensive automated validation ensures accuracy before statements are ever generated.

3. Proactive Financial Engagement

For appropriate service types, the system enables:

- Upfront patient estimates based on insurance benefits and fee schedules

- Pre-service payment options tied to expected responsibility

- Immediate post-service billing based on calculated estimates

- Reconciliation against actual insurance payments when processed

The constant challenge of explaining financial responsibility weeks after service is dramatically reduced. Patients receive clear, accurate financial information when it matters most—reducing both collection costs and patient frustration with delayed, unexpected bills.

4. Dynamic Vendor Management

Throughout the patient account lifecycle, the system:

- Routes accounts to appropriate vendors based on configurable rules

- Transfers accounts between internal, early-out, and collection paths

- Maintains complete account information across all transitions

- Ensures compliance with regulatory requirements for collections

The frustrating process of managing vendor handoffs is streamlined. Accounts no longer fall through the cracks during transitions—ensuring consistent follow-up throughout the collection process while preventing compliance issues related to improper notice or dual placements.

5. Automated Payment Application

When patients make payments, the system:

- Identifies all outstanding balances for the patient

- Applies payments according to configurable allocation rules

- Generates appropriate receipts and account updates

- Triggers next actions based on remaining balance status

The tedious process of manual payment posting is eliminated. Payments are applied quickly and accurately across accounts—improving both operational efficiency and the patient experience through immediate balance updates and clear communication.

Self-Service Innovation

Beyond backend automation, the solution enhances patient self-service capabilities:

Omnichannel Payment Options

The system provides:

- Mobile-friendly online payment portals

- Automated payment plan creation and management

- Flexible payment method options

- Clear visibility into payment history and application

The chronic struggle to meet patient expectations for digital convenience is addressed. Patients gain the same level of self-service control they experience in other industries—dramatically improving satisfaction while reducing the operational burden of payment processing.

Personalized Communication Strategies

Based on patient behavior and preferences, the system:

- Tailors communication channels to individual patients

- Adjusts messaging based on past payment patterns

- Optimizes timing of payment reminders

- Provides consistent messaging across all touchpoints

The perpetual challenge of determining effective communication strategies is resolved through systematic testing and optimization. Revenue cycle leaders gain unprecedented visibility into which approaches actually drive patient payments—creating a continuous improvement cycle that steadily increases collection rates.

Integration with the Complete Automation Roadmap

The patient billing automation solution represents the final component of our comprehensive automation strategy:

- Payment posting automation ensures accurate, timely posting of insurance payments

- 360-degree claim scrubbing prevents avoidable denials from occurring

- Automated denial response maximizes recovery for unavoidable denials

- Patient billing automation optimizes the patient financial experience

Together, these four components create an end-to-end automation framework that addresses the entire revenue cycle—from claim submission through ultimate collection.

Implementation Considerations

For experienced revenue cycle leaders evaluating this solution, key considerations include:

- Statement customization: Balancing information comprehensiveness with clarity and simplicity

- Write-off threshold settings: Determining economically optimal small balance parameters

- Vendor integration depth: Configuring data sharing with early-out and collection partners

- Payment application rules: Establishing priority hierarchies for multi-account scenarios

- Self-service adoption strategy: Planning the transition to patient-driven payment processes

Most organizations implement patient billing automation in phases, beginning with core statement generation and payment posting functions before expanding to more advanced capabilities. Full implementation typically requires 60-90 days, with measurable improvements in patient collection metrics visible within the first billing cycle.

Performance Metrics and ROI

Organizations implementing patient billing automation typically experience:

- 25-30% reduction in days to patient billing after insurance adjudication

- 15-20% improvement in self-pay collection rates

- 30-40% decrease in patient billing-related call volume

- 10-15% reduction in statement costs through consolidation

- 20-25% increase in online payment adoption

These improvements create both immediate operational benefits through reduced labor costs and substantial financial gains through improved collection rates and accelerated cash flow.

The Continuous Automation Management Ecosystem

All four automation components are supported by our continuous automation management process:

Real-Time Performance Monitoring

The system provides:

- Comprehensive dashboards tracking key performance indicators

- Automated alerts for unusual patterns or potential issues

- Comparative analytics against industry benchmarks

- Trend analysis to identify emerging opportunities or challenges

This visibility ensures that automation performance is continuously monitored and optimized, preventing the degradation that often occurs with static automation solutions.

Expert Co-Pilot Support

To ensure maximum effectiveness, the automation includes:

- Human-trained co-pilots working within your systems

- Timely management of any workflow exceptions

- Continuous rule refinement based on changing conditions

- Knowledge transfer to internal staff for long-term sustainability

This hybrid approach combines the efficiency of automation with the judgment of experienced revenue cycle professionals—creating a solution that continuously evolves with your organization’s needs.

Unified Workflow Management

All automation components integrate with our core platform that:

- Routes appropriate work to internal teams

- Provides context-rich work queues for efficient processing

- Delivers management visibility into team performance

- Enables seamless coordination between automated and manual processes

This unified approach ensures that work transitions smoothly between automated and manual handling—creating a cohesive revenue cycle operation that maximizes both efficiency and effectiveness.

Conclusion

The patient billing automation solution completes our comprehensive revenue cycle automation roadmap—creating an end-to-end framework that transforms the entire financial journey from claim submission through final payment. By implementing these four integrated automation components, healthcare organizations can simultaneously improve operational efficiency, enhance the patient experience, and optimize financial outcomes.

The future of revenue cycle management lies not in isolated point solutions, but in comprehensive automation ecosystems that address the entire revenue cycle while continuously adapting to changing conditions. Our integrated approach delivers this future today—empowering revenue cycle leaders to achieve unprecedented levels of performance while redirecting staff from routine processing to high-value activities that truly require human expertise.