Effective Verification and Authorization in Revenue Cycle Management

In the complex environment of healthcare finance, verification of benefits and authorization processes are crucial for maintaining a healthy revenue cycle. Errors or oversights in these early stages can lead to denials, increased administrative costs, and negatively impact the provider’s financial health. This article explores the challenges and strategies for optimizing these processes, drawing from recent industry discussions.

Challenges in Verification and Authorization in Revenue Cycle

The verification of benefits and authorization are foundational yet challenging aspects of revenue cycle management (RCM). These tasks are critical for confirming insurance coverage and ensuring services are authorized before they are provided. Failure in these areas can cause significant downstream problems, including claim denials.

- Insurance Verification in Revenue Cycle: This is essential for confirming a patient’s coverage before services are rendered. The process must accurately determine not just if the insurance is active but also what specific services are covered. It’s a multifaceted task that may require both electronic and manual efforts.

- Patient Responsibility Communication: With the rise of high deductible plans, it’s increasingly important to communicate financial responsibilities to patients upfront. This demands accurate, real-time access to patient coverage details, including deductible status and out-of-pocket costs.

- Authorization Efficiency: Gaps in obtaining necessary service authorizations can lead to denials. This area is fraught with challenges, from keeping up with payer-specific requirements to managing changes in planned services.

Strategies for Process Optimization

Addressing the challenges in verification and authorization requires targeted strategies that enhance accuracy and efficiency.

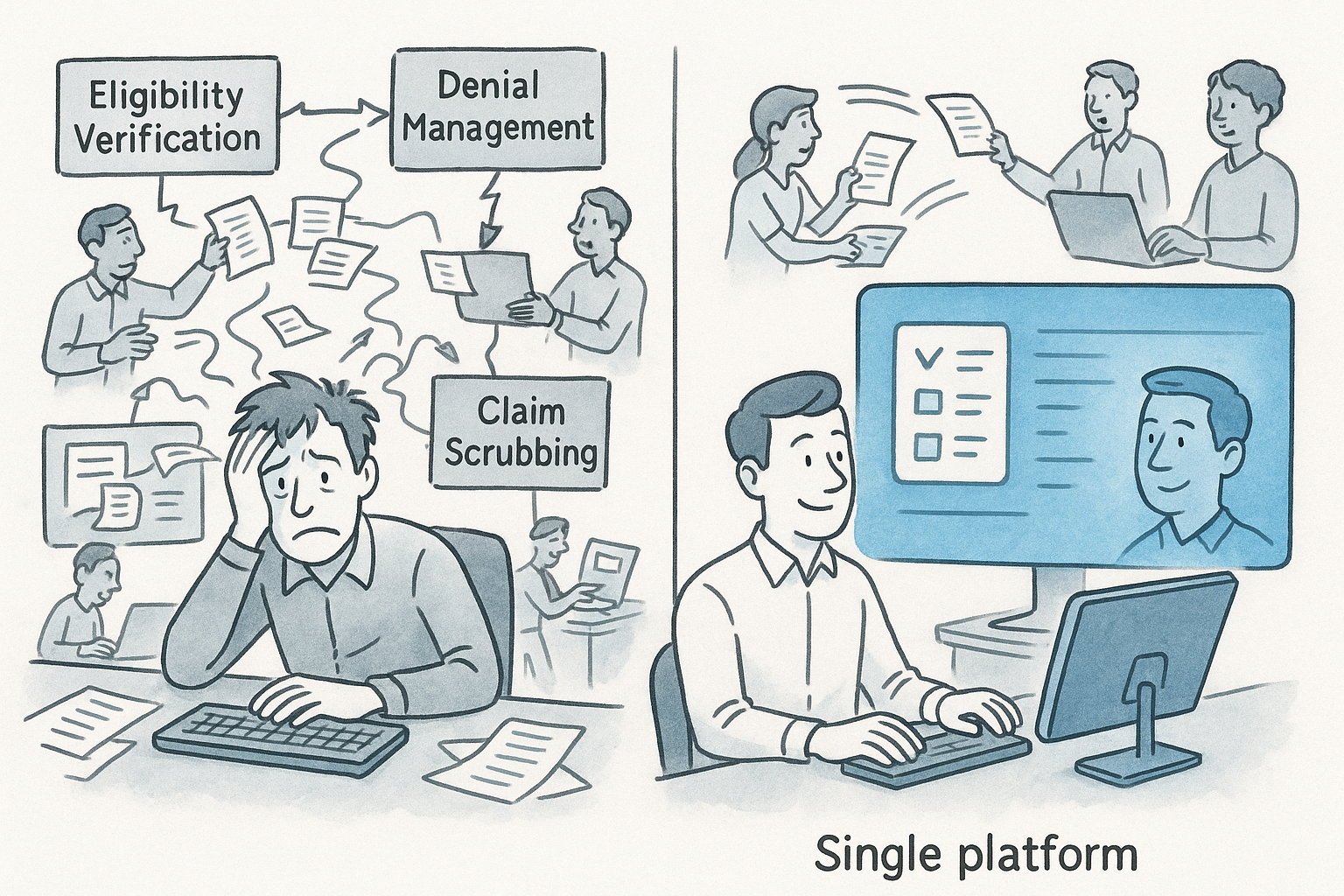

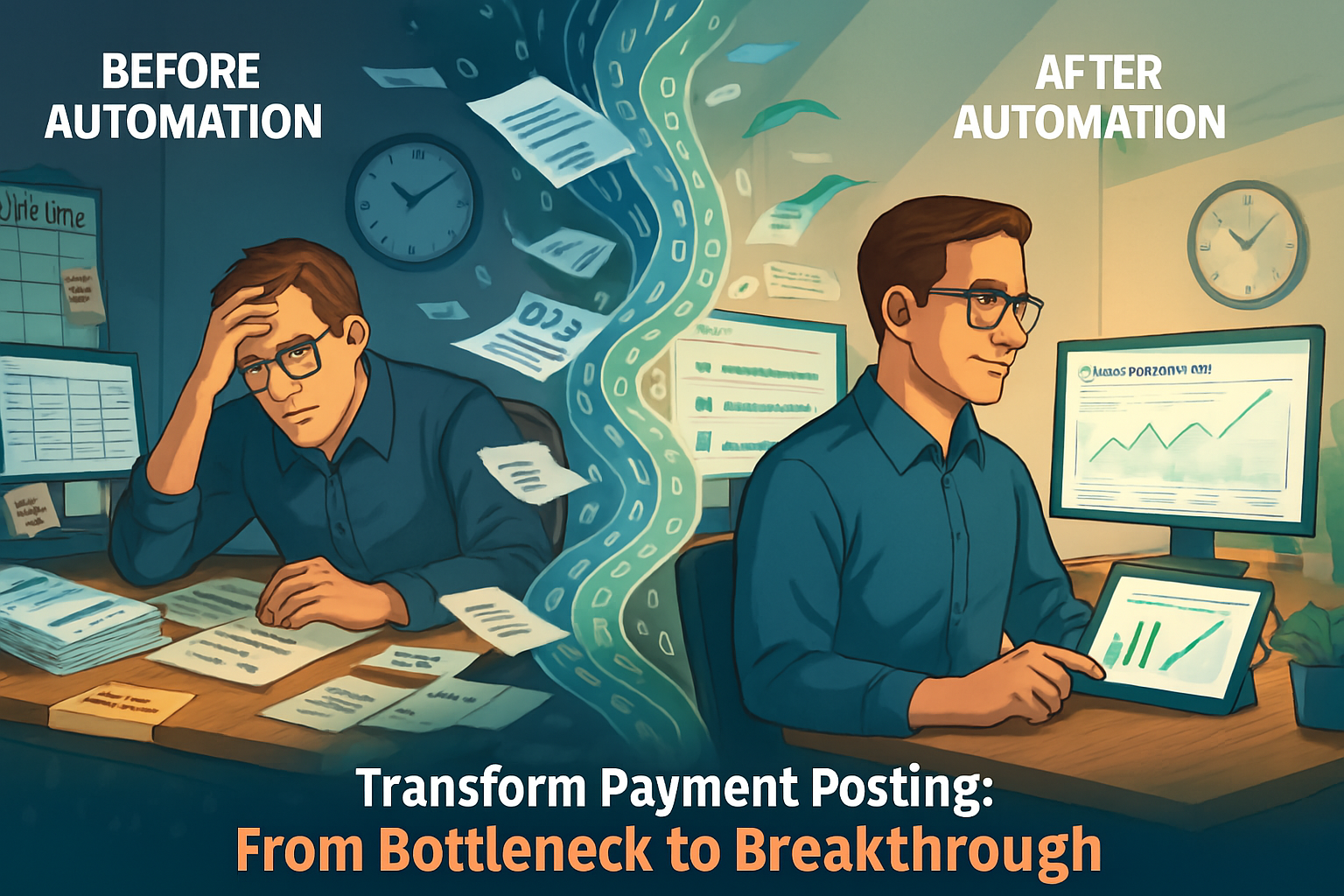

- Leveraging Technology in Revenue Cycle: Utilize electronic eligibility verification tools to streamline insurance checks. For practices still reliant on manual processes, incorporating automated solutions can significantly reduce errors and save time.

- Clarifying Patient Financial Responsibility: Ensure that EHR systems are updated with the latest fee schedules and that staff are trained to use this information to provide accurate estimates of patient responsibility. Transparency at the point of service can improve patient satisfaction and collections.

- Improving Authorization Processes in Revenue Cycle: Develop protocols for managing authorizations, including regular audits to ensure compliance with payer requirements. Training staff on these protocols and using technology to track authorization statuses can minimize denials.

Data-Driven Insights for Improvement in Revenue Cycle

Analysis of denial data can offer valuable insights into where the verification and authorization processes may be falling short. For example:

- Denial Trends: Regularly review denial reasons related to eligibility and authorization. Identifying patterns can help pinpoint systemic issues or specific areas needing attention.

- Adjustment Analysis: Distinguish between contractual and non-contractual adjustments to uncover hidden operational issues. Mismanaged adjustment codes can obscure the real reasons for revenue loss.

Empowering Frontline Staff

Operational improvements are most effective when they involve those who work directly with these processes. Engaging with frontline staff to understand their challenges and gather feedback on existing workflows can uncover practical insights for improvement. Solutions might include:

- Process Reengineering: Simplifying check-in procedures or improving how insurance verifications are performed can have a significant impact. This might involve reassigning responsibilities or introducing new checklists to ensure completeness.

- Staff Training and Support: Regular training sessions on using verification tools and understanding when and how to manage the failed verifications can be highly beneficial. Additionally, designing well scripted phrases that elicit accurate and up-to-date insurance information from patients can be empowering to the frontline.

Conclusion

Optimizing the verification of benefits and authorization processes is essential for reducing denials and enhancing the financial health of healthcare providers. By embracing technology, focusing on patient communication, and engaging with staff, providers can address the challenges inherent in these critical RCM tasks. As the healthcare industry continues to evolve, maintaining efficient and accurate verification and authorization practices will be key to navigating its complexities successfully.