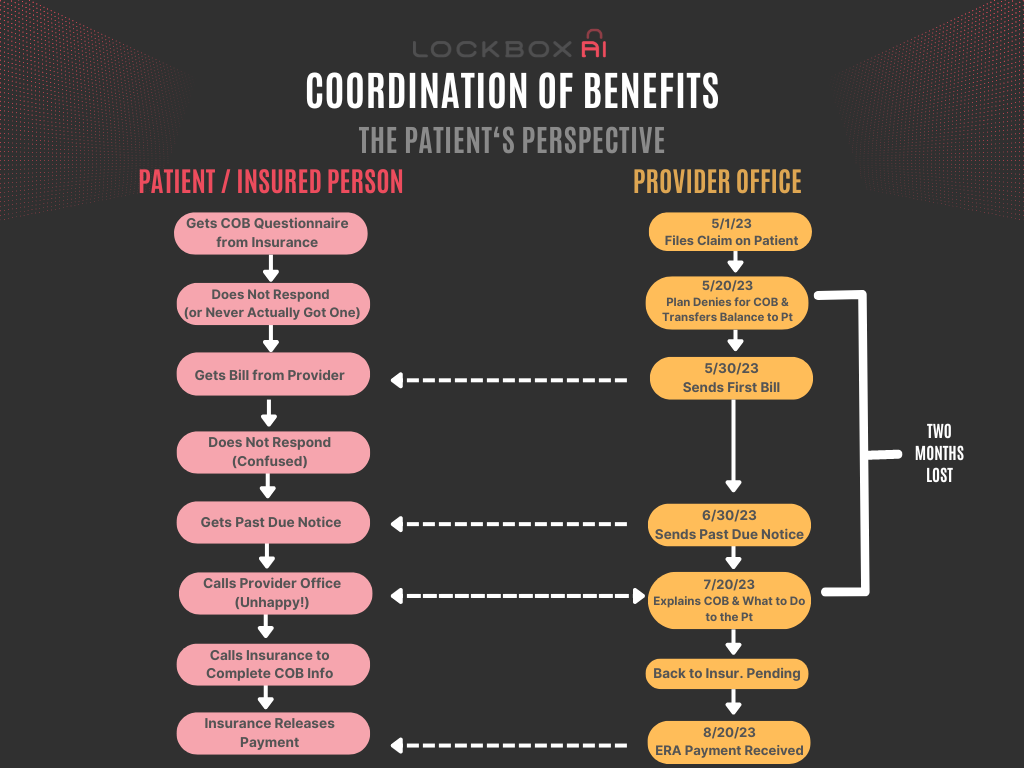

Coordination of Benefits – The Patients’ Perspective

Coordination of Benefits (COB) denials can negatively impact revenue cycle and patient relationships. It all starts with a seemingly harmless phrase on a patient’s bill: “Coordination of Benefits (COB) Needed.” However, this vague statement can trigger a cascade of negative consequences, from patient confusion and frustration to delayed payments and increased administrative burdens.

Most practices unknowingly exacerbate the issue by mishandling COB communication, leaving patients in the dark about why their claim was denied and what steps to take next. This not only damages your bottom line but also erodes patient trust and satisfaction. Take a look at the consequences of pushing COB denials to patient due; also provided are actionable strategies to turn this obstacle into a smooth, patient-friendly experience.

Here’s how practices mishandling “COB needed” on patient bills can cause a cascade of problems:

- Patient Confusion: Just the term “COB needed” is vague. It doesn’t tell the patient why that information is necessary or how to provide it. This leads to confusion and frustration, especially with the threat of a pending bill.

- Delayed Action: Without a clear call to action, many patients will put off dealing with something labeled “COB.” They might hope it resolves itself or not realize the urgency, leading to late payments or denied claims.

- Strained Patient-Provider Relationship: Vague billing statements can breed distrust. Patients might feel they’re being charged unjustly or that the practice is incompetent. This erodes the patient’s willingness to cooperate with future communications.

- Increased Administrative Burden: The practice now potentially has a denied claim and needs to recontact the patient, explain the situation, and reprocess the paperwork. This wastes valuable resources and further delays care reimbursement.

- Higher Potential for Billing Errors: When COB is handled later in the process, there’s more chance of error. The wrong payer might be billed initially, or the amount due from the patient might be miscalculated due to incorrect secondary payer coverage.

- Negative Patient Experience: The entire process is frustrating and time-consuming for the patient, damaging the practice’s reputation. Patients dealing with medical issues don’t need added billing stress.

What Practices Should Do Instead

- Proactive Coordination of Benefits Identification: Collect and verify COB information at the time of service, whenever possible.

- Clear Communication on Statements: If COB information is missing, bills should:

- Explain COB denial in layman’s terms.

- Clearly outline the steps the patient needs to take.

- Provide contact information (phone, website) for further assistance

- Multi-Channel Follow-Ups: Don’t rely solely on mailed bills. Follow up with phone calls or, if patient consent is obtained, texts/emails.

- Staff Training: Ensure all staff, from front desk to billing, have a well-written script for all to use to effectively communicate Coordination of Benefits follow-through to patients.

Other Frontline Reminders

While it’s helpful to have patients sign forms regarding their insurance coverage, there are some limitations to keep in mind:

Forms That Might Help:

- Patient Registration Form: A comprehensive registration form can include:

- Sections for primary and secondary insurance details: (Policyholder name, policy numbers, group numbers, etc.)

- Authorization for COB: A statement granting the practice permission to coordinate benefits, including contacting insurers.

- Agreement to Notify of Coverage Changes: A line for the patient to acknowledge their responsibility to inform the practice of any insurance updates.

- Financial Responsibility Agreement: This form may outline:

- The patient’s obligation to pay for services even if there are COB issues.

- Cooperation with providing necessary information for billing.

Why Forms Alone Aren’t a Perfect Solution for Coordination of Benefits Denials

- Insurance Changes: Even with signed forms, patients’ insurance coverage can change mid-year. Jobs change, spouses’ plans adjust, and people enroll in different coverage. Therefore, practices can’t rely solely on an annual form.

- Specificity on Coordination of Benefis Acceptance: It’s unlikely a payer will broadly accept a form in lieu of following their specific COB procedures when it comes to complex billing situations.

- Incomplete Information: Patients might not remember all their coverage, leading to inaccurate or missing information on forms.

- Verification Still Necessary: Practices still need to verify insurance details directly with payers. Signed forms aren’t a substitute for eligibility checks and claim validation.

Best Practices

- Forms + Verification: Consider the forms mentioned above as tools to streamline the insurance collection process, but always pair them with ongoing verification directly with payers.

- Regular Reminders: At intervals (not just annually), remind patients about the importance of updating insurance information as needed. This could be through signage, website messaging, or even appointment reminder texts.

- Technology Solutions: Some practice management systems allow patients to input and update their insurer information online. This can improve accuracy and reduce data entry burden for staff.

In Summary

While a well-worded form can help obtain initial insurance information and set expectations, it’s not a foolproof solution to Coordination of Benefits complexities. A proactive approach that combines patient education, regular verification, and technology tools will ultimately serve practices and patients better.