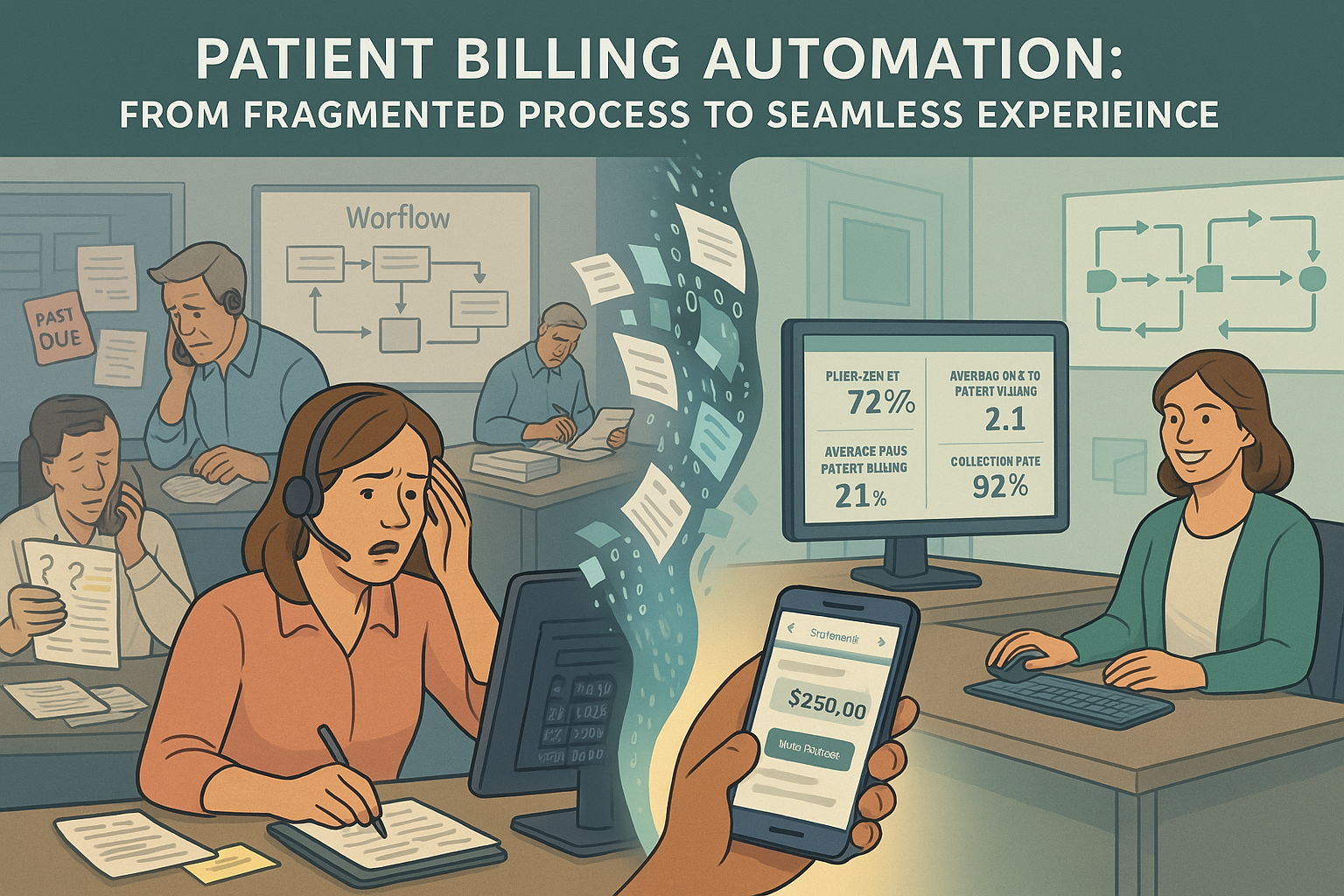

In an environment where payer requirements constantly evolve and denial rates continue to climb, the traditional approach to claim submission has become increasingly costly. Despite investments in EHR scrubbing tools and clearinghouse validation, preventable denials continue to plague revenue cycle operations, creating rework that strains resources and delays reimbursement.

Beyond Basic Scrubbing: The Pre-Submission Gap

Most revenue cycle operations rely on a combination of EHR edits and clearinghouse scrubbing to validate claims before submission. While these tools catch fundamental errors, they leave critical gaps that result in preventable denials:

- Outdated eligibility information: The frustration of having claims denied for coverage termination when the information was available but not verified prior to submission represents one of the most avoidable denial categories. Few things are more exasperating than watching otherwise clean claims rejected for basic eligibility issues that could have been identified with a simple pre-submission check.

- Missing or invalid authorizations: The administrative burden of tracking down authorization information after a claim has been denied creates unnecessary work and patient satisfaction issues. The particular aggravation of discovering an authorization was obtained but not properly documented on the claim—or worse, that it contained a simple transcription error—exemplifies the type of preventable denial that proper pre-submission validation eliminates.

- Payer-specific requirements: The constant challenge of keeping up with unique payer rules creates ongoing frustration as requirements shift without notice. The maddening experience of having a claim that was paid last month suddenly denied this month due to an unpublished policy change represents one of the most irritating aspects of revenue cycle management.

- Incomplete charge capture: The revenue leakage that occurs when charges fail to transfer from ancillary systems creates both financial and compliance concerns. The dismaying realization that claims have been submitted without all applicable charges—requiring voids, corrections, and resubmissions—creates unnecessary rework and payment delays that could have been prevented with proper validation.

These gaps in traditional scrubbing approaches don’t just create denials—they generate entire workflows of preventable follow-up work that consumes staff time and delays reimbursement.

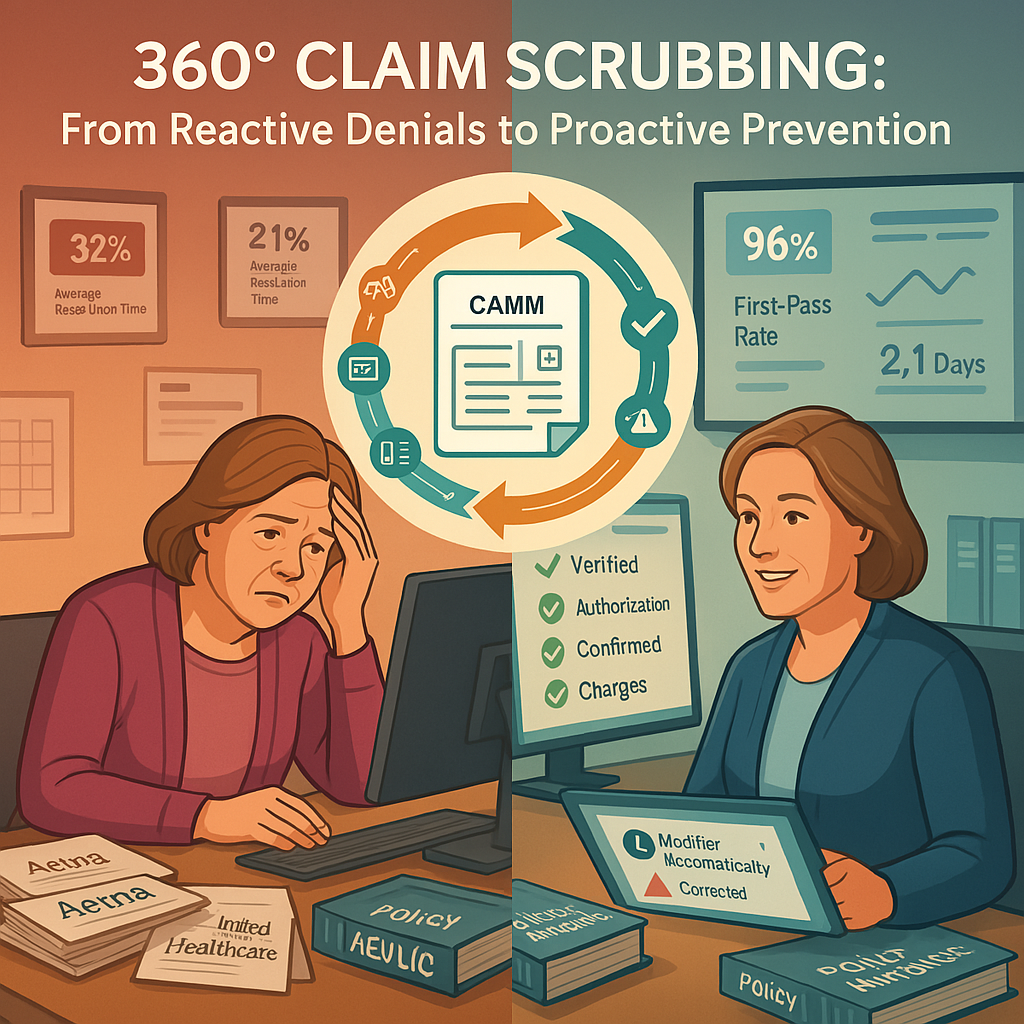

The 360-Degree Claim Scrubbing Solution

Building on the insights gained from payment posting automation, our comprehensive pre-submission validation solution provides a multi-layered approach to ensuring clean claims:

1. Real-Time Eligibility Verification

The system automatically:

- Confirms current eligibility status before claim submission

- Verifies patient and subscriber information against payer databases

- Identifies coverage changes that occurred since service date

- Validates correct insurance information is applied to the claim

The relief of eliminating eligibility-related denials cannot be overstated. No more tedious tracking of coverage changes or discovering that a simple data entry error at registration has resulted in weeks of payment delays and multiple touchpoints to resolve.

2. Authorization Validation Framework

For services requiring authorization, the system:

- Verifies authorization numbers against payer records

- Confirms procedure codes match authorized services

- Validates service dates fall within authorization periods

- Ensures referring provider information matches authorization

The persistent headache of managing authorization requirements across different payers becomes significantly reduced. Revenue cycle leaders no longer face the particular frustration of having claims denied for authorization issues that could have been easily corrected prior to submission—if only the information had been properly verified.

3. Payer-Specific Billing Rule Engine

Drawing from continuously updated payer guidelines, the system checks:

- Code combinations specific to each payer

- Required modifiers based on service context

- Diagnosis code specificity requirements

- Units of service limitations and frequency rules

The ongoing battle to keep up with constantly changing payer requirements becomes manageable. The system eliminates the infuriating discovery that a previously established billing pattern suddenly results in denials due to an undocumented payer policy change.

4. Comprehensive Charge Validation

Before claim submission, the system:

- Verifies all expected charges are present

- Identifies potential missing charges from ancillary systems

- Confirms all related services are included

- Validates charge completeness based on documented services

The revenue leakage that occurs due to incomplete charge capture is dramatically reduced. The frustrating realization that claims were submitted without all applicable charges—requiring voids, corrections, and resubmissions—becomes a rare exception rather than a routine occurrence.

Intelligent Edit Processing

When the system identifies potential issues, it takes one of two approaches:

Automated Corrections

For straightforward, non-clinical edits, the system can:

- Apply missing modifiers based on service context

- Update subscriber information to match payer records

- Insert authorization numbers from verified sources

- Standardize provider information to match credentialing data

The tedium of making repetitive administrative corrections is eliminated, freeing staff from monotonous data entry and reducing the risk of human error in the correction process.

Guided Manual Intervention

For edits requiring clinical judgment or policy decisions, the system:

- Presents specific recommendations to billing staff

- Provides context for why the edit is necessary

- Documents the source of the rule triggering the edit

- Tracks edit acceptance rates to improve future recommendations

The chronic struggle to understand why claims are being flagged and what specific action to take is resolved. Staff no longer waste time researching payer requirements or guessing at appropriate corrections, instead receiving clear, actionable guidance that accelerates the resolution process.

Continuous Improvement Through Denial Integration

Unlike static scrubbing tools, the system leverages insights from the payment posting automation to:

- Identify new denial patterns as they emerge

- Automatically create new scrubbing rules based on denial trends

- Adjust validation logic based on payer behavior changes

- Create payer-specific rule sets that evolve with policy changes

The perpetual challenge of keeping scrubbing rules current with payer requirements is addressed through this feedback loop. Revenue cycle leaders no longer face the dispiriting task of manually updating rules after denials have already occurred—the system proactively adapts based on real-world payment outcomes.

Implementation Considerations

For experienced revenue cycle leaders evaluating this solution, key considerations include:

- Rule customization approach: Balancing standard rule sets with organization-specific modifications

- Integration with existing workflows: Determining optimal insertion points in the claim creation process

- Alert tolerance settings: Configuring appropriate thresholds for different alert types

- Staff training strategy: Preparing billing teams to interpret and act on system recommendations

- Performance measurement: Establishing baseline metrics to evaluate impact

Organizations typically implement 360-degree claim scrubbing in phases, beginning with highest-value denial categories and expanding to more complex validation rules over time. Full implementation and optimization typically occurs over a 60-90 day period, with measurable results beginning to appear within the first 30 days.

Performance Metrics and ROI

Organizations implementing comprehensive claim scrubbing typically experience:

- 30-40% reduction in preventable denials

- 15-20% decrease in claim resubmission volume

- 5-7% improvement in first-pass payment rates

- 10-15% reduction in A/R days for clean claims

- 20-25% decrease in staff time spent on denial management

These improvements create both immediate operational benefits through reduced rework and long-term financial gains through accelerated reimbursement and reduced write-offs.

Building on Payment Posting Automation

The 360-degree claim scrubbing solution represents the logical second step in the automation roadmap, building directly on the insights gained from payment posting automation:

- Payment posting automation provides visibility into denial patterns and payer behavior

- Claim scrubbing applies those insights to prevent future denials

- Together, they create a continuous improvement cycle that progressively reduces denial volume

This synergy ensures that your revenue cycle becomes increasingly efficient over time, with each component enhancing the effectiveness of the others.

Conclusion

By implementing 360-degree claim scrubbing, revenue cycle operations move from a reactive denial management posture to a proactive clean claim strategy. Rather than dedicating resources to fixing preventable denials, staff can focus on addressing more complex revenue opportunities and enhancing the patient financial experience.

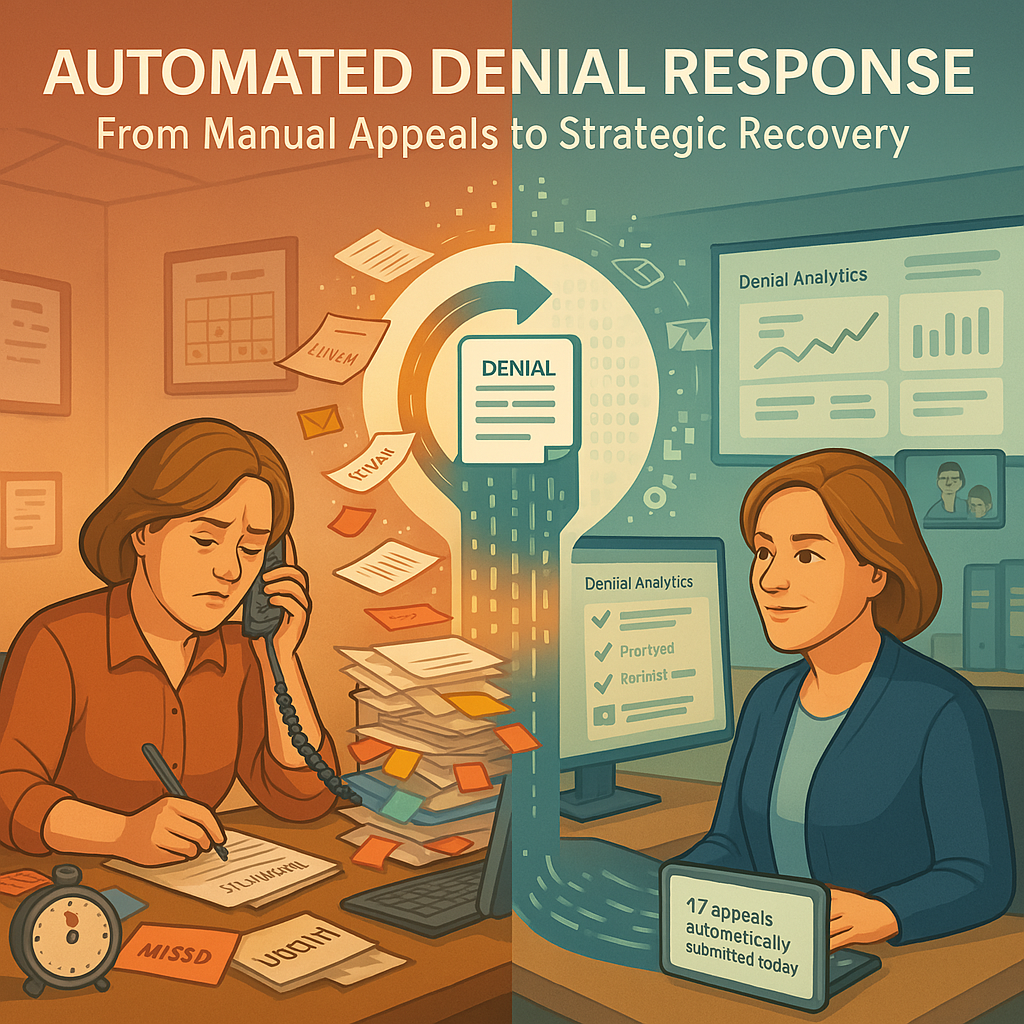

In our next article, we’ll explore how the foundation established by payment posting automation and claim scrubbing enables the third component of our automation roadmap: automated denial response and appeals management.