Revenue Cycle Management (RCM) is a crucial process in healthcare, encompassing the identification, management, and collection of patient service revenues. As healthcare systems become increasingly complex, achieving RCM goals requires more than just advanced technology and robust systems—it demands a collaborative effort among various stakeholders within the organization. This article explores how teamwork, communication, and shared objectives are essential in optimizing RCM and driving financial health for healthcare providers.

The Importance of Collaboration in Achieving RCM Goals

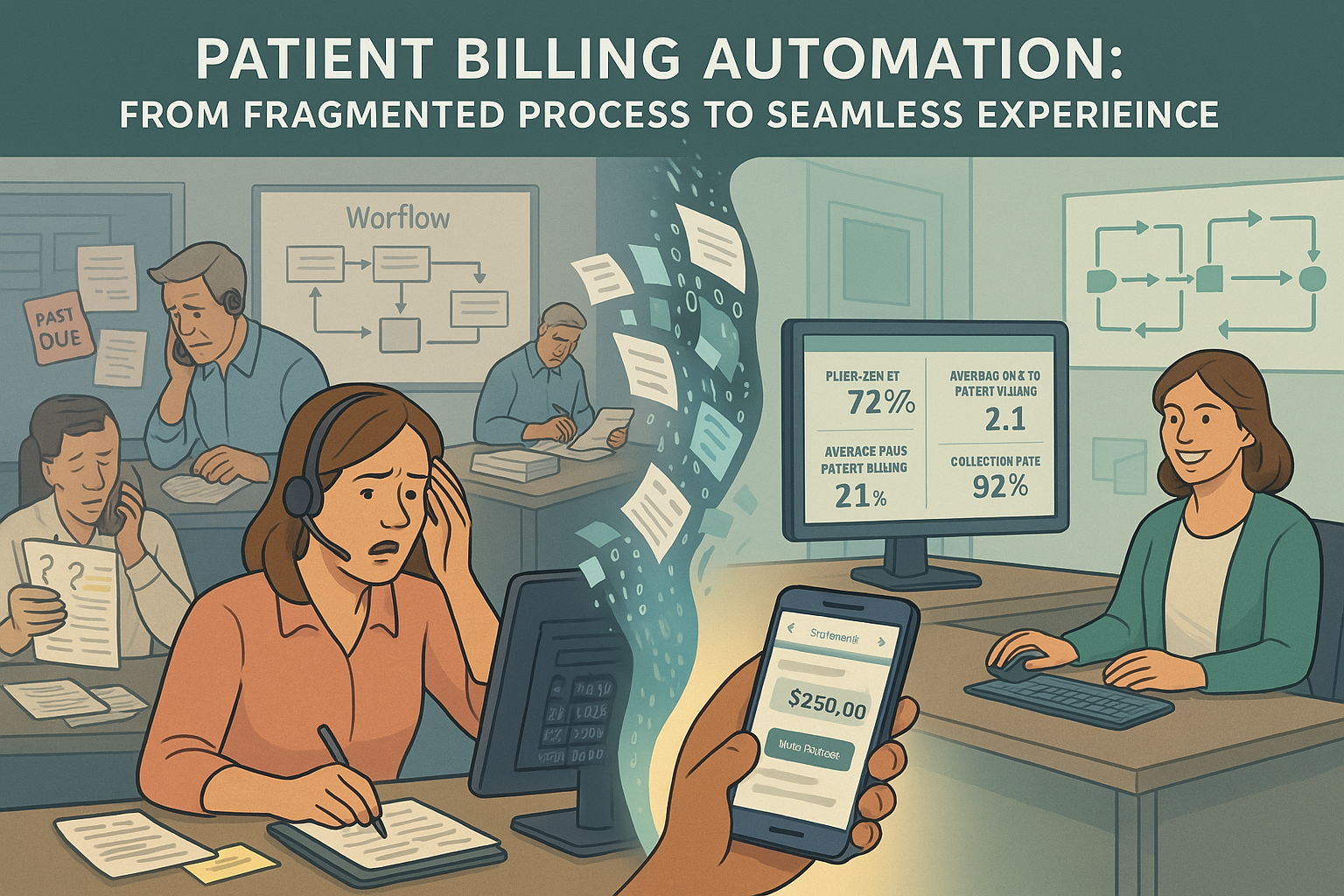

The revenue cycle in healthcare involves multiple stages, from patient registration and insurance verification to billing, claims processing, and collections. Each stage requires precise coordination and integration across different departments. By fostering a culture of collaboration, healthcare organizations can streamline these processes, reduce errors, and enhance efficiency.

- Breaking Down Silos to Achieve RCM Goals

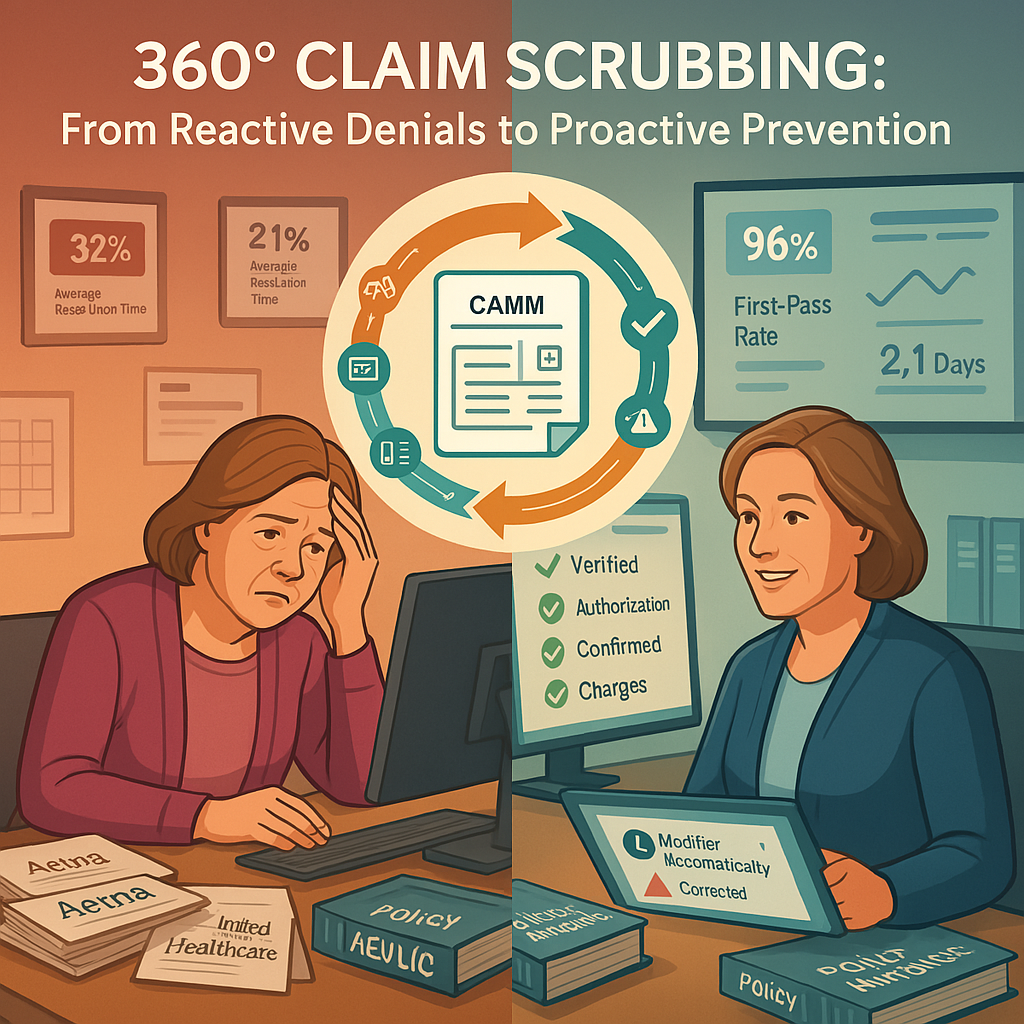

One of the primary barriers to effective RCM is the existence of silos within the organization. Departments such as front desk, billing, coding, and finance often operate independently, leading to miscommunication and delays. By breaking down these silos and encouraging interdepartmental collaboration, organizations can ensure that information flows seamlessly from one stage of the revenue cycle to the next. For example, when the front desk staff accurately captures patient information and communicates it effectively to the billing department, it reduces the chances of errors in claims submission. - Shared Goals and Objectives for RCM Success

Aligning the goals of various departments with the overall RCM objectives is vital. When each team understands how their work contributes to the broader financial health of the organization, they are more likely to take ownership of their roles and collaborate effectively. Establishing clear, measurable goals and regularly communicating progress can foster a sense of shared purpose. For instance, setting a collective goal to reduce the average days in accounts receivable (AR) can motivate teams to work together to identify bottlenecks and implement solutions. - Effective Communication to Meet RCM Goals

Transparent and frequent communication is the cornerstone of successful collaboration. Regular meetings, cross-functional teams, and open channels of communication can help address issues promptly and keep everyone aligned. For example, a monthly RCM meeting that includes representatives from each department can be an effective platform to discuss challenges, share updates, and develop strategies collectively.

Overview of Current Challenges in RCM Goals

The revenue cycle management (RCM) landscape is increasingly complex, presenting numerous challenges for both in-house teams and outsourced vendors. The evolving nature of insurance plans, rising patient responsibility, and the intricacies of Medicare Advantage plans have made it difficult for RCM departments to maintain consistent collections. The reality of high-deductible insurance plans necessitates a heightened focus on patient payment both pre- and post-service. However, a significant portion of patient responsibility remains uncollected.

Key Challenges in Revenue Cycle Management

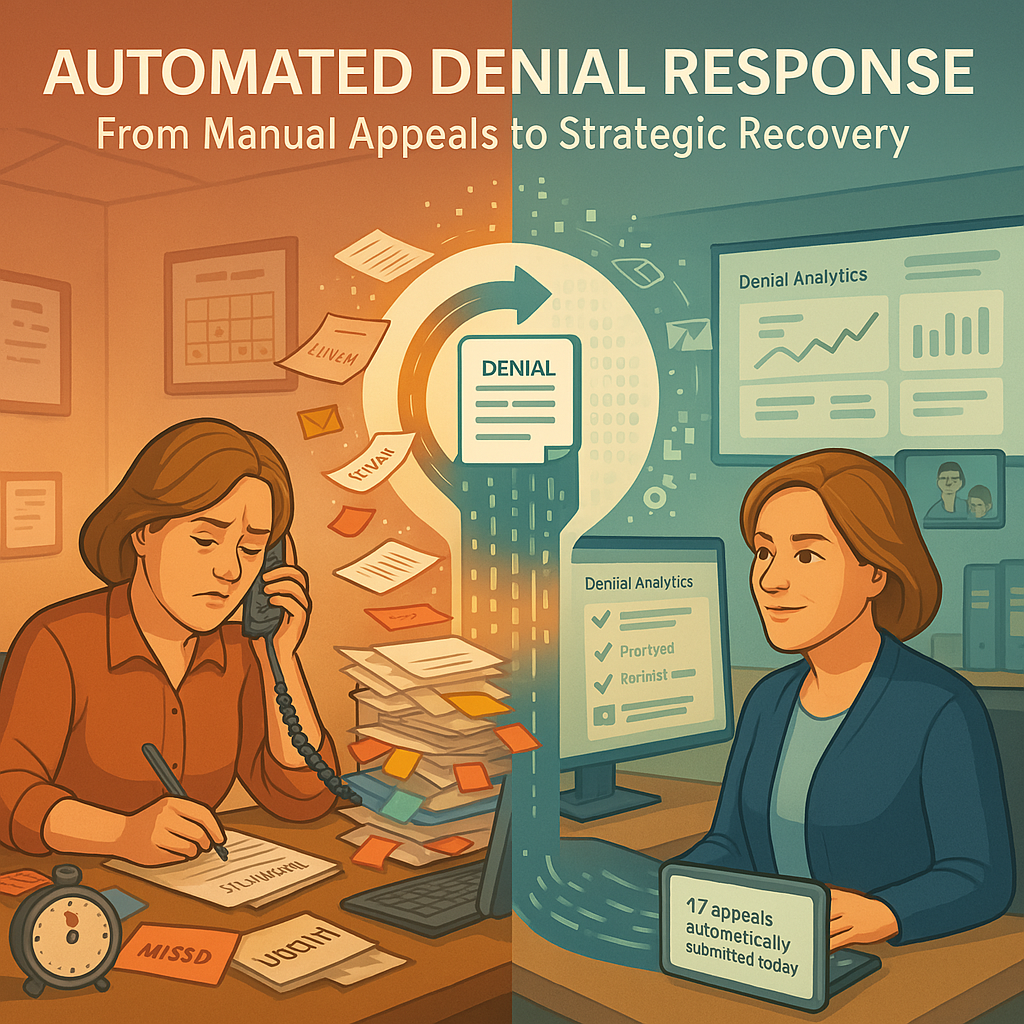

- Insurance Plan Complexity: The variety and complexity of insurance plans require detailed attention to manage claims and denials effectively.

- Medicare Advantage Plans in RCM Goals: These plans introduce new hurdles in prior authorizations, increasing denials and underpayments.

- Claim Denials: Persistent claim denials lead to higher labor costs and lower collections, straining RCM departments.

- AI in Insurance: Insurance payers leverage AI to discover new denial methods, scrutinize medical records, and reduce covered services.

- Legacy Technology: Outdated EHR systems compel teams to use manual workarounds, complicating operations and data reporting.

Current Solutions and Their Limitations

Efforts to implement robotic process automation (RPA) in RCM have not yielded the expected returns. Development and maintenance costs are high, making it difficult to achieve desired ROI. Similarly, the promise of AI in RCM has often fallen short, failing to deliver tangible benefits.

Staffing and Retention Issues

RCM leaders face significant challenges in recruiting and retaining staff. High wages offered by other employers, the industry’s complexity, and diminished employee loyalty contribute to staffing difficulties. Outsourcing and offshoring RCM operations have had mixed results, with some providers opting to bring operations back in-house.

Effective Outsourcing Strategies

Outsourcing RCM can be beneficial, but it requires careful consideration of vendor agreements. Vendors typically prefer a percentage of collections model, but the specifics of what is included or excluded can vary.

Points to Consider:

- Negotiation on Carve-outs: Ensure clear agreements on what is included in the percentage of collections. For example, patient co-pays or collections from third parties should be explicitly defined.

- Effort-Based Payment: Vendors should be compensated based on their efforts. Collections achieved without vendor involvement should not be included in their percentage.

- Communication: Effective communication with RCM vendors is crucial. Highlighting areas that can bring in more revenue benefits both the provider and the vendor.

Training and Development to Meet RCM Goals

Continuous training and development are essential to equip staff with the skills and knowledge needed for effective collaboration. Regular training sessions on RCM processes, technology, and best practices can enhance competence and confidence. Moreover, cross-training staff on different aspects of the revenue cycle can foster a deeper understanding of the entire process and promote empathy and cooperation among team members.

Conclusion

Handling the complexities of RCM requires a strategic approach. By understanding current challenges, leveraging effective outsourcing strategies, and ensuring clear communication with vendors, providers can optimize their revenue cycle operations. Addressing these issues proactively will lead to improved collections, reduced labor costs, and enhanced overall efficiency in managing the revenue cycle.