Understanding Medical Necessity Denials

At the heart of medical necessity denials lies the concept of determining whether a particular healthcare service or treatment is essential for the diagnosis, treatment, or prevention of a patient’s condition. Insurance companies employ various criteria, often based on clinical guidelines and industry standards, to evaluate the necessity of requested services. However, these criteria can sometimes be rigid and fail to account for the unique circumstances of individual patients.

We’ve all been there – staring at a medical necessity denial for a service that was clearly essential. The frustration is compounded by knowing that the issue lies somewhere in the complex interplay of documentation, coding, and payer bureaucracy.

It’s not about the “why,” it’s about the “how”

As seasoned billers and coders, we understand the concept of medical necessity. Our challenge isn’t grasping whether or not the treatment was warranted – it’s about bridging the gap between a patient’s clinical care and an insurer’s rigid parameters for proof.

Understanding the Landscape:

- Variable Factors: Medical necessity decisions hinge on:

- Insurance type: Each plan has unique coverage guidelines and medical necessity criteria.

- Specific service: Procedures with varying evidence levels supporting effectiveness face different coverage decisions.

- Patient history: Individual medical conditions and prior treatments influence the necessity determination.

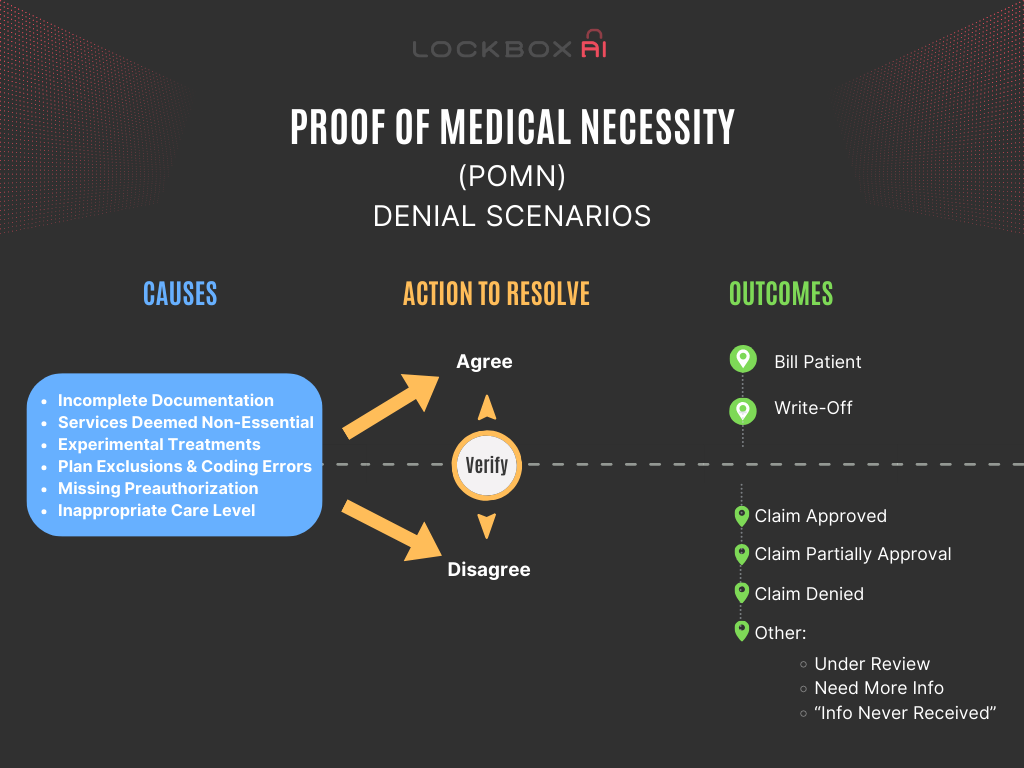

Common Culprits of Medical Necessity Denials:

- Incomplete Documentation: Missing details, unclear diagnosis, or weak justifications in medical records hinder approval.

- Services Deemed Non-Essential: Insurers have criteria for what’s considered necessary for specific conditions. Deviations can lead to denials.

- Experimental Treatments: Coverage typically excludes treatments lacking sufficient evidence of effectiveness.

- Plan Exclusions: Certain services might be explicitly excluded from your specific insurance coverage.

- Coding Errors: Inaccurate coding can lead to misinterpretations by the insurer.

- Missing Preauthorization: Required pre-approvals not obtained beforehand can result in denials.

- Inappropriate Level of Care: Services deemed appropriate for a lower level of care (e.g., outpatient vs. inpatient) might be denied.

The Root Cause for Medical Necessity Denials:

To effectively resolve denials, identify the cause:

- Analyze Explanation of Benefits (EOB): This document details the denial reason and relevant policy references.

- Review Clinical Documentation: Ensure the provider’s notes clearly justify the service’s medical necessity.

- Confirm Coding Accuracy: Verify the accuracy of diagnosis and procedure codes used.

Resolving the Denial and Preventing Future Issues:

-

- Appeal the Denial: If you believe the denial is in error, submit an appeal with additional clinical documentation and justification.

- Collaboration and Communication: Collaborate with the provider to obtain missing information and directly communicate with the insurer to clarify coverage or request reconsideration. Seek external help for complex cases.

Proactive Measures:

-

- Obtain prior authorization for services prone to denials.

- Encourage providers to comprehensively document treatment rationale, medical urgency, and anticipated benefits.

- Utilize qualified coders and perform thorough claim reviews.

- Stay informed about evolving policies, criteria, and coding updates.

Billing Implications and the No Surprise Act:

Whether a denied claim can be billed to the patient depends on several factors:

- Insurance Type: Commercial insurance policies may allow billing in specific scenarios, while Medicare and Medicaid generally prohibit it.

- Advance Beneficiary Notice (ABN): Signing an ABN informs the patient of potential non-coverage and financial responsibility.

- State Regulations: Some states have additional regulations regarding billing for denied services.

- No Surprise Act: This act promotes transparency and offers avenues for patients to challenge potentially unfair bills.

Strategies for Navigating Medical Necessity Denials

Despite the challenges posed by medical necessity denials, there are strategies that patients and providers can employ to increase their chances of a successful appeal:

- Thorough Documentation: Ensuring comprehensive documentation of medical records, test results, and clinical notes can strengthen the case for medical necessity.

- Clinical Justification for Medical Necessity Denials: Providing detailed clinical justification, supported by evidence-based research and expert opinion, can bolster the appeal.

- Utilizing Resources: Leveraging resources such as patient advocacy organizations, legal assistance, and healthcare professional networks can provide valuable support during the appeals process.

- Persistence: Persistence is key when navigating medical necessity denials. Following up regularly and escalating the appeal as necessary can demonstrate commitment and determination.

Conclusion:

Medical necessity denials plague healthcare organizations, impacting revenue, patient care, and efficiency. Understanding the causes, navigating the appeals process, and implementing preventive measures can significantly improve claim acceptance rates and financial stability. Remember, clear communication, accurate documentation, and proactive strategies are key to navigating this landscape.